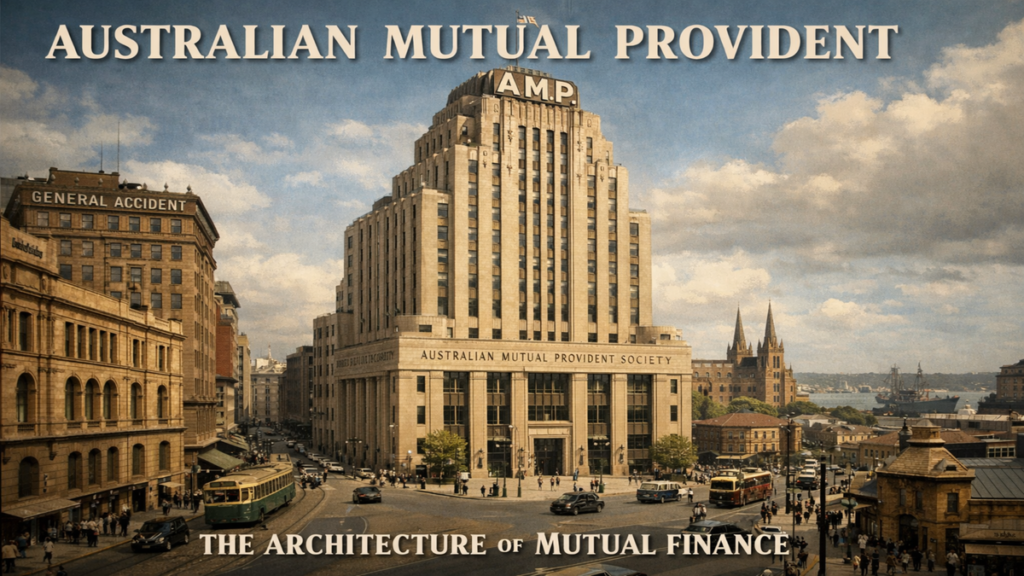

I approach Australian Mutual Provident as a business story rooted in structure rather than spectacle. People searching for this topic usually want to know what Australian Mutual Provident was, why it mattered, and how its legacy still influences financial institutions today. Those questions sit at the intersection of governance, incentives, and long term economic behavior.

In its simplest form, Australian Mutual Provident was a mutual financial institution built to serve its members rather than external shareholders. That single design choice shaped everything that followed. Product design, investment strategy, expansion pace, and public communication all flowed from the principle that policyholders were owners. This mattered because insurance and retirement planning demand trust measured in decades, not quarters.

I have studied shareholder driven finance and mutual finance side by side. The contrast is not theoretical. It is operational. Mutual institutions move slower, absorb shocks differently, and prioritize solvency over rapid growth. Australian Mutual Provident became one of the most durable examples of that model in Australia and beyond.

This article explains Australian Mutual Provident as a business system. I focus on how it worked, how it expanded, why it eventually transformed, and what modern financial firms can still learn from its structure. The goal is clarity, not nostalgia.

The Founding Logic of Australian Mutual Provident

The institution now remembered as Australian Mutual Provident emerged in a period when formal financial safety nets barely existed. Life insurance was not a consumer convenience. It was a survival tool. Families relied on pooled risk to protect themselves from sudden loss of income due to death or illness.

Australian Mutual Provident adopted a mutual assurance model from its earliest days. Members paid premiums into a shared pool, and benefits were paid from that collective fund. There were no external investors extracting profit. Surpluses belonged to members.

This structure required discipline. Premiums had to be priced conservatively. Reserves had to be maintained even when economic conditions encouraged expansion. Management incentives favored caution because failure would harm the same people who funded the system.

From a business perspective, this alignment of incentives reduced moral hazard. The institution could not gamble with member funds to chase growth. That restraint became a competitive advantage over time.

Governance Without Shareholders

One of the most distinctive features of Australian Mutual Provident was its governance model. Ownership was distributed across policyholders rather than concentrated in equity markets. Voting rights and influence were structured around membership rather than capital accumulation.

I find this governance approach particularly relevant today. Without shareholder pressure, management decisions focused on long term sustainability. Executive compensation, expansion strategies, and product complexity were constrained by the need to maintain trust.

This governance model also influenced transparency. Communication with members was not marketing driven. It was explanatory. Policyholders needed to understand how funds were managed because they were, in effect, co owners.

The absence of shareholder activism did not eliminate accountability. It shifted it. Accountability flowed toward actuarial soundness and member outcomes rather than share price performance.

Core Products and Their Design Philosophy

Australian Mutual Provident built its business around a focused set of products. Life insurance formed the foundation. Over time, retirement savings and pension products followed as demographic needs evolved.

These products were intentionally simple. They were designed to be held for decades, not optimized frequently. This reduced behavioral risk among members who might otherwise react emotionally to market fluctuations.

The table below outlines the core product categories and their intended purpose.

| Product Type | Primary Goal | Typical Duration |

|---|---|---|

| Life insurance | Family income protection | Long term |

| Endowment policies | Savings plus protection | Long term |

| Pensions | Retirement income stability | Long term |

| Investment funds | Capital growth with control | Medium to long |

This structure reinforced a culture of patience. Products rewarded consistency rather than timing.

Investment Strategy and Risk Management

Australian Mutual Provident developed a conservative investment approach that emphasized diversification and capital preservation. Assets were allocated across government securities, property, infrastructure, and selected equities.

Rather than chasing maximum returns, the focus remained on meeting long term liabilities. This mattered because insurance obligations extend decades into the future. Short term volatility could undermine confidence even if long term returns looked attractive.

I have reviewed similar investment philosophies across mutual institutions globally. The common thread is survival bias. Institutions that last a century prioritize downside protection over upside potential.

This approach also aligned with national development goals. Long term investments in infrastructure and housing generated steady returns while supporting broader economic stability.

Expansion Without Aggression

As Australian Mutual Provident grew, it expanded geographically with caution. New markets were entered only after demographic analysis, mortality studies, and regulatory assessment.

This slow expansion limited headline growth but increased durability. The institution avoided overexposure to volatile regions or speculative asset classes.

From a business strategy perspective, this expansion model resembles modern risk adjusted scaling. Growth occurred when it strengthened the system rather than strained it.

I have seen fast growing financial firms collapse under their own complexity. Australian Mutual Provident avoided that fate for generations by treating expansion as a privilege rather than an entitlement.

Cultural Role and Public Trust

Beyond balance sheets, Australian Mutual Provident shaped financial behavior. It normalized saving, long term planning, and premium discipline within households.

Policies were often treated as obligations rather than optional expenses. That mindset reduced lapse rates and strengthened the collective pool.

Financial historian Mark Delaney once observed, “Mutual institutions succeed when they shape habits, not just products.” That insight applies directly here.

Public trust was reinforced through consistent communication. Members received updates explaining performance, bonuses, and outlooks. This transparency reduced panic during economic downturns and strengthened loyalty.

Pressures That Challenged the Mutual Model

By the late twentieth century, the financial environment changed. Competition intensified. Financial products became more complex. Capital requirements increased. Shareholder driven firms gained speed and scale advantages.

Australian Mutual Provident faced structural limits. Remaining mutual constrained access to external capital and reduced flexibility in competitive markets.

I view this moment not as institutional failure, but as systemic pressure. Mutual models struggled globally under similar conditions.

Management faced a tradeoff between preserving structure and adapting to survive. That tension set the stage for demutualization.

Demutualization and Structural Transformation

Demutualization converted Australian Mutual Provident from a member owned institution into a shareholder owned corporation. Policyholders received shares, transforming collective ownership into individual equity.

This unlocked capital and enabled expansion into broader financial services. It also altered incentives. Shareholder expectations introduced new performance metrics and time horizons.

The contrast between eras is summarized below.

| Dimension | Mutual Structure | Shareholder Structure |

|---|---|---|

| Ownership | Policyholders | Investors |

| Priority | Member security | Profit growth |

| Time focus | Decades | Years |

| Risk tolerance | Low | Higher |

This transformation reshaped governance, culture, and public perception.

Lessons for Modern Financial Firms

Australian Mutual Provident offers enduring lessons. Incentive alignment matters. When customers are owners, trust compounds naturally. When ownership separates from usage, governance must compensate.

Another lesson concerns time. Long term liabilities require long term thinking. Short term optimization can undermine institutional credibility.

I see renewed interest in mutual principles within fintech and cooperative finance. While full mutual models remain rare, hybrid structures increasingly borrow from their logic.

Takeaways

- Australian Mutual Provident was built on member ownership and trust

- Mutual governance aligned incentives toward stability

- Simple products reduced behavioral risk

- Conservative investments supported longevity

- Demutualization altered priorities and culture

- Its legacy still informs modern financial design

Conclusion

I see Australian Mutual Provident as a case study in how structure shapes outcomes. Its mutual model produced stability, trust, and long term alignment that modern finance often struggles to replicate. While demutualization brought adaptability, it also diluted the original social contract.

The institution’s history reminds us that financial systems are not neutral. They embed values through incentives and governance. Australian Mutual Provident embedded patience and responsibility into its design.

For modern businesses navigating short term pressure, that lesson remains relevant. Longevity is engineered, not accidental.

Read: https://claudemagazine.com/business/google-ad-revenue-2025-q4-report/

FAQs

What was Australian Mutual Provident?

Australian Mutual Provident was a member owned financial institution focused on insurance and retirement security.

Why was it considered a mutual organization?

Because policyholders collectively owned and governed the institution rather than external shareholders.

What led to its demutualization?

Competitive pressure, capital needs, and regulatory change drove structural transformation.

How did demutualization affect members?

Members received shares but lost collective ownership and long term alignment.

Why does Australian Mutual Provident still matter?

Its structure influenced financial governance, trust, and long term planning norms.